IRS Form 8879: How to E-File Tax Returns by an ERO

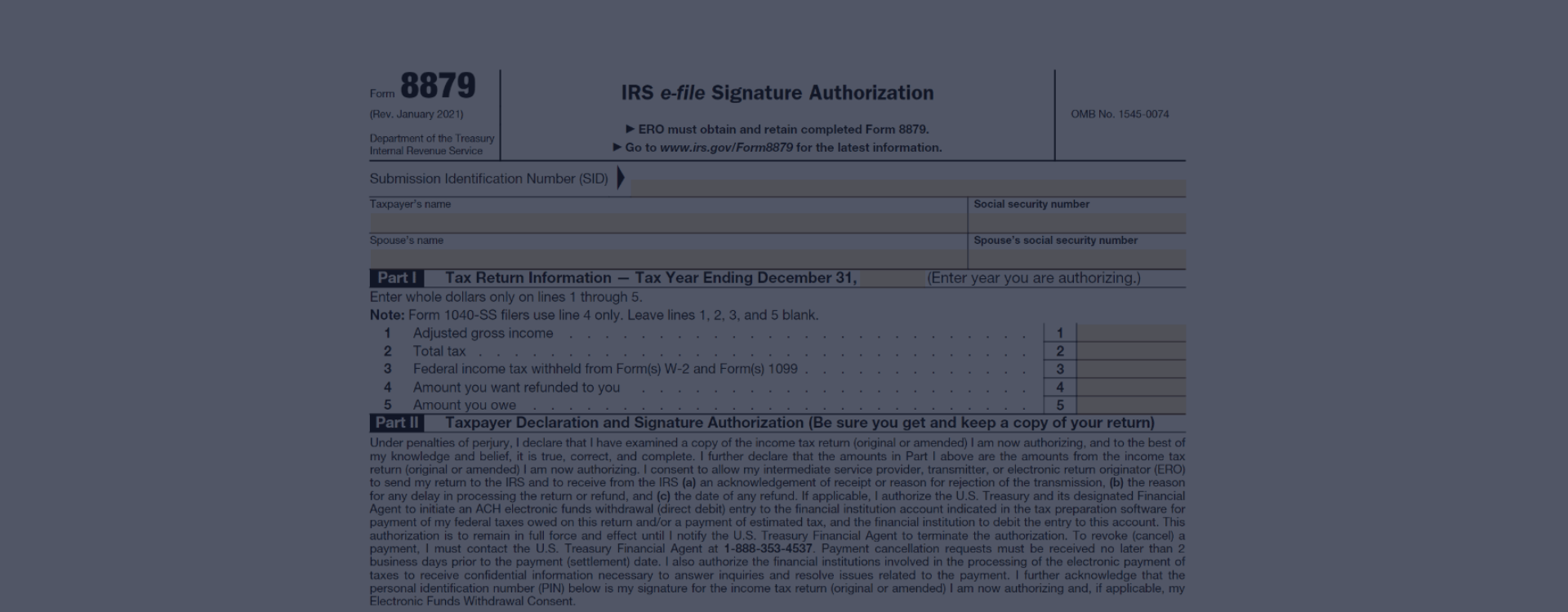

Widely known U.S. tax form 8879 is a crucial document that taxpayers need to sign and submit when they electronically file their income annual returns. It authorizes the e-filing of the taxpayer's federal income annual declaration and serves as a declaration that the information provided in return is accurate and complete to the best of the taxpayer's knowledge. It is important to note that the printable IRS Form 8879 does not replace the need for taxpayers to sign and retain a copy of their tax returns for their records.

Get the Relevant Instructions & Examples

The website 8879irsform.com offers valuable resources to help individuals navigate the process of completing and submitting their federal tax form 8879. By providing detailed instructions, easy-to-follow examples, and an IRS Form 8879 for download, the website ensures that taxpayers can confidently and accurately complete the copy. Furthermore, the site's user-friendly layout and comprehensive materials make the process of understanding and filling out this crucial tax form more manageable, reducing the risk of errors and potential penalties. By utilizing the resources available on 8879irsform.com, taxpayers can ensure they take the necessary steps to properly submit their electronic tax returns and remain compliant with IRS regulations.

Terms to Use the 8879 Tax Form

Generally speaking, the application must be filed by taxpayers who have their tax returns prepared and signed electronically by an Electronic Return Originator (ERO). The ERO must obtain the taxpayer's signature on this form to authorize the electronic submission of their tax return.

One example of a person who must fill out a blank 8879 form for 2022 is Susan, a freelance graphic designer from New York City. Susan had a successful year with several high-profile clients, significantly increasing her annual income. As a result, she decided to hire an ERO to handle the preparation and submission of her tax return. Because the ERO is filing her tax return electronically, Susan must complete and sign Form 8879 to authorize this submission.

Another individual who needs to submit a sample of the 8879 form is George, a small business owner in San Francisco. George operates a boutique furniture store and has recently expanded his business to include online sales. Due to the growth of his business and the increased complexity of his financial situation, George has opted to work with an ERO to file his tax return electronically. Consequently, George must also complete and sign Form 8879 from IRS for 2022 to authorize the ERO to submit his tax return on his behalf.

File Form

IRS Form 8879 Advantages

-

![Time Saver]() Time SaverIt streamlines the tax filing process by allowing taxpayers to electronically sign and submit their income returns, cutting down on paperwork and mailing time.

Time SaverIt streamlines the tax filing process by allowing taxpayers to electronically sign and submit their income returns, cutting down on paperwork and mailing time. -

![Enhanced Security]() Enhanced SecurityIt ensures that the taxpayer's sensitive personal and financial information is securely transmitted to the IRS, reducing the risk of data breaches and identity theft.

Enhanced SecurityIt ensures that the taxpayer's sensitive personal and financial information is securely transmitted to the IRS, reducing the risk of data breaches and identity theft. -

![Faster Refunds]() Faster RefundsElectronically filing taxes with Form 8879 results in quicker processing by the IRS, meaning taxpayers can expect to receive their refunds sooner than if they filed paper returns.

Faster RefundsElectronically filing taxes with Form 8879 results in quicker processing by the IRS, meaning taxpayers can expect to receive their refunds sooner than if they filed paper returns.

Printable 8879 Tax Form & How to Fill It Out

Filling out the blank copy can be a straightforward process if you follow IRS Form 8879 instructions carefully. This form is essential for authorizing an electronic signature on your tax return, which can expedite processing and minimize errors.

- First, start by obtaining a printable tax form 8879, which can be found on the official IRS website. Make sure you have all the necessary information handy, such as your Social Security number, adjusted gross income, and any refund or amount owed.

- When completing the form, pay close attention to each box and enter the required data accurately. Boxes 1-3 need your name, Social Security number, and spouse's Social Security number (if applicable). Box 4 requires the tax year, while box 5 is for the electronic return originator's (ERO) information.

- To avoid mistakes, double-check all entered information and ensure it matches your tax return. When signing IRS Form 8879 for electronic signature, be aware that this serves as an official legal document. Therefore, it's crucial to review it thoroughly before submitting it to your ERO.

Due Date to File Form 8879 in 2023

Filing your taxes accurately and on time is essential to avoid any potential penalties. The due date for submission IRS Form 8879 printable is usually April 15th, unless you have requested an extension. In case of missing the deadline or providing misleading information on this form, you could face penalties imposed by the IRS. It's crucial to understand the consequences of not adhering to the rules when filing IRS Form 8879 PDF. Penalties can range from monetary fines to more severe actions depending on the nature of the offense.

Printable Template

Filing Form 8879:IRS e-file Signature Authorization, can be done in a couple of ways. The first option is to use the printable version of the form. This method has its advantages, such as being able to physically review the document before submitting it and having a hard copy for your records. Additionally, some individuals may prefer the tactile experience of filling out the copy by hand, which can help reduce errors.

Fillable 8879 PDF & Its Pros

On the other hand, online filing of federal form 8879 provides several benefits that might make it a more appealing option for taxpayers. For instance, submitting the sample electronically is often faster and more convenient than mailing in a paper version. Furthermore, digital filing reduces the risk of lost or damaged documents and allows for easier tracking of the submission status. Ultimately, the choice between the two methods depends on individual preferences and circumstances.

Fill Now

Form 8879 & Signature Authorization Instructions

- What are the instructions for IRS Form 8879, and who needs it?It's essential to follow the instructions provided by the IRS to complete the template accurately, ensuring a smooth e-filing process. There are detailed explanations of the critical rules taxpayers need to follow to avoid issues with the IRS and don't receive any penalties or fines for breaking the law.

- Can I find a fillable Form 8879 online?Yes, you can find a fillable 8879 PDF on the official website of the Internal Revenue Service (IRS). Simply visit any trustworthy website about taxation, search for "Form 8879," and download the fillable PDF version. This allows you to enter the required information directly on the sample before printing and signing it.

- How can I download Form 8879 from the IRS website?Visit the IRS website and use the search bar. Once you find the form, click on the link to access the PDF file, which you can then download to your computer. Ensure you have a PDF reader installed on your device to open and view the form.

- What is the purpose of the 8879 federal tax form?It authorizes an Electronic Return Originator (ERO) to e-file a taxpayer's income tax return. The taxpayer and the ERO sign the form, confirming that the information on the tax return is accurate and complete. This document is a legal document and ensures that the taxpayer consents to the e-filing process.

- Can I obtain a blank 8879 form to fill out manually?Yes, you can download a blank 8879 template from the IRS website to fill out manually. However, using the fillable PDF version provided on the website is more convenient and less prone to errors. This way, you can type in the required information, reducing the risk of mistakes caused by illegible handwriting.

More About Electronic Signature

IRS Form 8879 - Printable PDF Tax season can be a daunting time for many individuals, especially when it comes to filing the necessary forms. One such form, the 8879, may be required by some taxpayers. In this article, we will discuss how to obtain the printable blank PDF, the rules to fill in the form appropriately, how to file...

IRS Form 8879 - Printable PDF Tax season can be a daunting time for many individuals, especially when it comes to filing the necessary forms. One such form, the 8879, may be required by some taxpayers. In this article, we will discuss how to obtain the printable blank PDF, the rules to fill in the form appropriately, how to file... - 29 March, 2023

- Federal Tax Form 8879 - Fillable Template Navigating the world of taxes can be a daunting task, especially when it comes to an understanding and filing specific forms such as the 8879 form. This article aims to make the process of filing the fillable IRS 8879 form smooth and effortless by providing a step-by-step guide on obtaining, complet...

- 28 March, 2023

- IRS Form 8879 Instructions Today, I want to talk about Form 8879, a document that's been giving many people headaches. But fear not! I'm here to provide some guidance on how to tackle this form with ease. The IRS Form 8879 Main Purpose First off, let's talk about what Form 8879 is and when you might need to use it. This app...

- 27 March, 2023

Printable IRS Form 8879

Get FormPlease Note

This website (8879irsform.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.